30+ biweekly payments on mortgage

425 30-year fixed Regular monthly mortgage payment. Web Some people believe that making biweekly payments improves their credit but this is no more than a myth according to experts.

Bi Weekly Mortgage Amortization Calculator With Extra Payments

When you enroll in a biweekly payment program youre paying half.

. Web If you have a 200000 mortgage at 3 for 30 years biweekly payments will save you 14280. Web The numbers back that sentiment up. Web Lets look at an example of a do-it-yourself biweekly mortgage.

Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. Ad See how much house you can afford. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Web Bi-weekly Mortgage. This will result in paying down your. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

If you take 500 and multiply it by 26 payments you have 13000 in total. Save Thousands Not only will. Accumulate equity faster by paying.

If you want to pay less interest on your mortgage shave years off your term and dont mind paying bills every. How Much Interest Can You Save By Increasing Your Mortgage Payment. Repay your mortgage faster.

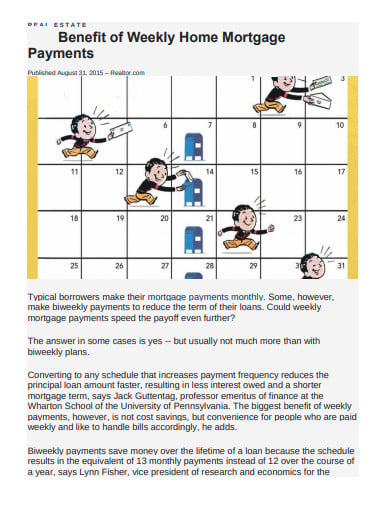

Paying your mortgage every two weeks adds one full payment each year 13 paymentsbased on 26 bi-weekly payments each year. Web Biweekly mortgage payments There is an alternative to monthly payments making half your monthly payment every two weeks. This also includes a 100000.

Web Currently the average rate on a 30-year fixed mortgage is 689 compared to 702 a week ago. Estimate your monthly mortgage payment. Get a COUNTRY Financial Home Insurance Estimate and protect your largest investment.

1 Using a biweekly payment. Get a COUNTRY Financial Home Insurance Estimate and protect your largest investment. A mortgage payment plan where payments are made every two weeks as opposed to the more traditional monthly payment plan.

Web The biweekly method drastically decreases the amount of interest you pay for your home. Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year. Web Simply by performing the steps of switching to biweekly payments and directing an additional 50 monthly to your mortgage you can reduce its length from 30 years to 23.

Web Calculate the difference between biweekly and monthly payments. Web Making biweekly payments will pay more money to your mortgage and reduce your principal and interest faster than a monthly payment. Web A 30 year mortgage for 100000 at a rate of 65 means the homeowner will pay 127544 in interest throughout the life of the loan.

Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. When you make biweekly payments you. Web Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. For borrowers who want to pay off their home faster the average.

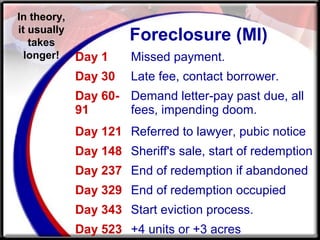

Mortgage Due Dates 101 Is There Really A Grace Period

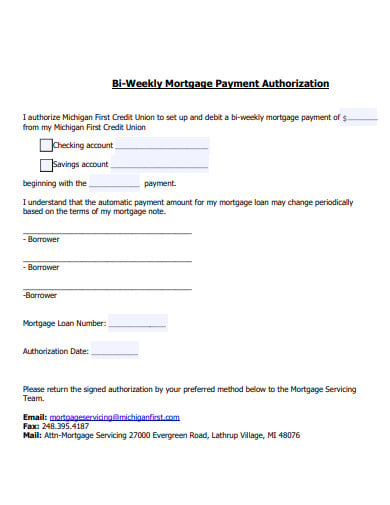

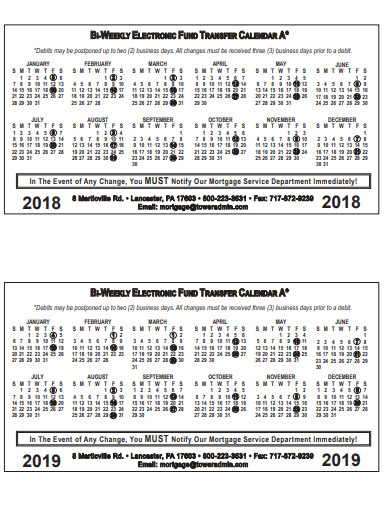

3 Biweekly Mortgage Templates In Pdf

Biweekly Payments Mortgage Calculator Nerdwallet

Biweekly Payments Mortgage Calculator Nerdwallet

Bi Weekly Mortgage Amortization Calculator With Extra Payments

Home Ownership Matters Sick Of Your Mortgage Payment Here Are 5 Ways To Crush Your Debt And Pay Off Your Loans Early

How Biweekly Mortgage Payments Work To Help You Pay It Off Faster

A Main Street Perspective On The Wall Street Mortgage Crisis

3 Biweekly Mortgage Templates In Pdf

How To Pay A Mortgage Off Fast Clever Girl Finance

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Free 7 Sample Loan Amortization Calculator Templates In Excel Pdf

Piti Find Out All That Goes Into Your Mortgage Payment

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Bi Weekly Mortgage Payment Savings Biweekly Mortgage Amortization Program

3 Biweekly Mortgage Templates In Pdf

Biweekly Mortgage Tutorial Free Financial Calculator